An antenuptial contract and Its Place in Marriage Law

Antenuptial Contracts Explained: Exactly How They Can Profit Your Future With Each Other

Antenuptial agreements offer as important lawful tools for couples preparing for marital relationship. They define just how properties and obligations will certainly be taken care of, promoting clearness in monetary issues. These arrangements can be particularly useful in securing specific interests and guiding complex family dynamics. Comprehending their importance might question concerning just how they can form a couple's future. What specific benefits could an antenuptial contract offer in your distinct situation?

What Is an Antenuptial Agreement?

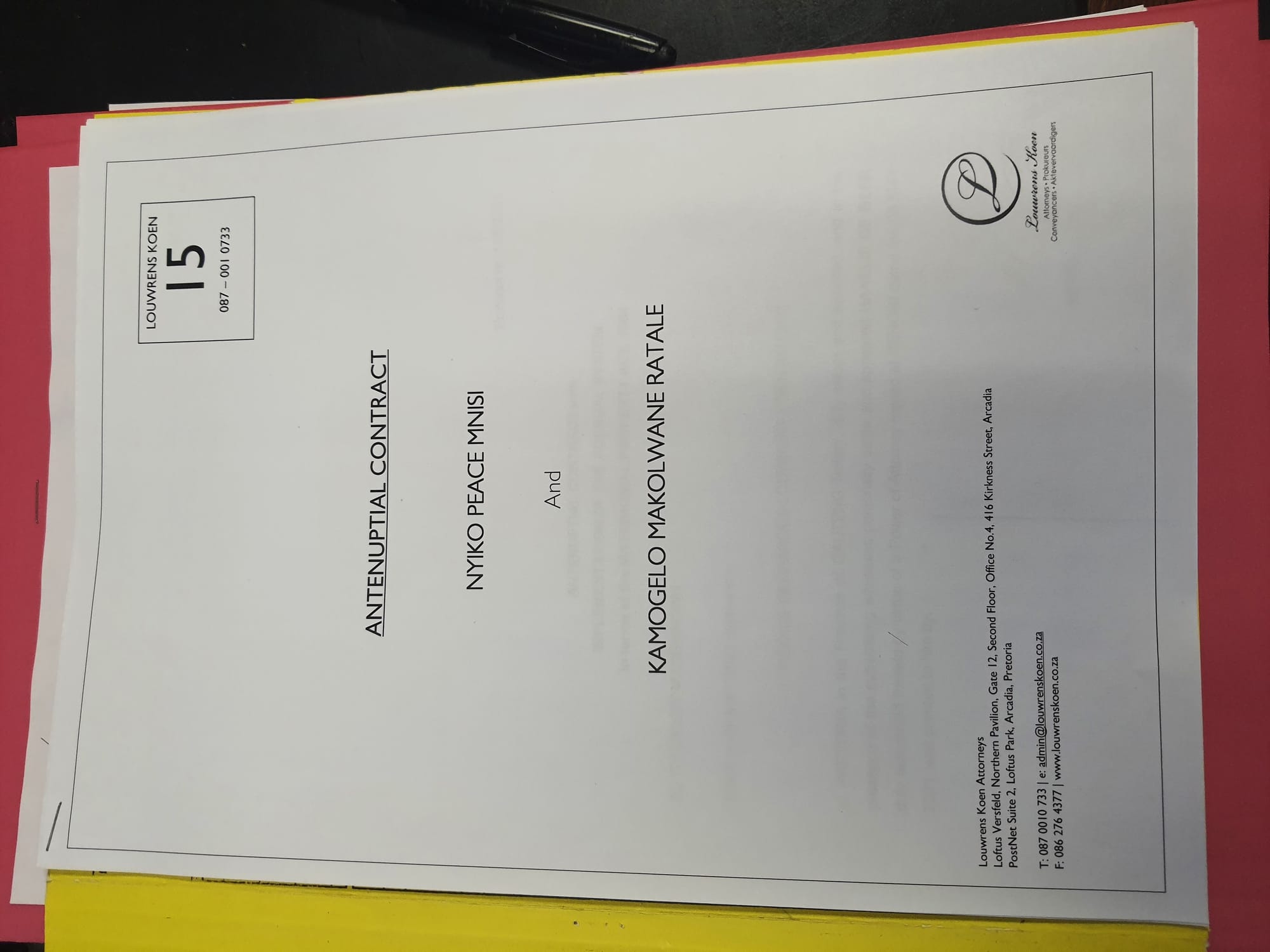

An antenuptial agreement, usually referred to as a prenuptial contract, is a lawful paper produced by two people before their marriage. This contract outlines the monitoring and division of possessions and obligations in case of separation or death. Normally, it includes stipulations pertaining to residential or commercial property civil liberties, spousal assistance, and inheritance. The main purpose of an antenuptial contract is to establish clear expectations and shield each party's economic interests. It can likewise assist to decrease dispute must the marital relationship end. While usually connected with rich people, such agreements can benefit couples of varying monetary histories. By addressing prospective problems in breakthrough, an antenuptial contract can give both events with satisfaction as they become part of their marriage.

The Relevance of Financial Openness

Financial openness is vital in any type of relationship, especially when preparing an antenuptial contract. Open up interaction about financial resources enables both partners to understand each various other's responsibilities and possessions completely. This quality can greatly lower the capacity for financial problems in the future.

Open Up Communication Regarding Finances

Just how can pairs navigate the complexities of their monetary lives without open interaction? In partnerships, transparency concerning financial resources fosters count on and understanding. When partners honestly discuss their monetary situations, goals, and problems, they develop a strong structure for common decision-making. This discussion helps protect against misconceptions and builds a feeling of team effort in taking care of finances. Pairs ought to establish a regular for going over economic matters, enabling them to attend to any kind of problems prior to they rise. By establishing clear expectations and reviewing spending routines, cost savings goals, and debt monitoring, companions can straighten their monetary priorities. Ultimately, open communication concerning financial resources not just reinforces the connection however likewise prepares couples for future challenges, guaranteeing they get on the exact same page as they browse their financial journey with each other.

Understanding Each Various other's Assets

While steering via the complexities of a shared financial future, recognizing each other's properties becomes vital for couples. Financial openness cultivates count on and lays a solid structure for the connection. By honestly discussing their individual possessions, companions can better appreciate each various other's financial histories, toughness, and susceptabilities. This understanding assists in straightening their economic objectives and assumptions, producing a unified strategy to budgeting and investments. Couples that recognize the worth of their consolidated properties are most likely to make informed choices pertaining to residential property, financial investments, and savings. Eventually, this clearness not just boosts shared respect however likewise prepares couples to encounter potential monetary difficulties together, making certain a much more secure and harmonious collaboration progressing.

Minimizing Monetary Disputes Later On

Open communication regarding financial resources can substantially decrease the capacity for disputes later in a relationship. Antenuptial agreements function as a foundation for this transparency, clearly outlining each companion's monetary obligations and expectations. By reviewing properties, financial debts, and earnings honestly, couples establish trust and understanding, lessening misunderstandings that could bring about disputes. Financial openness allows both people to express their concerns and goals, promoting partnership rather than competitors. This aggressive strategy not just strengthens the collaboration but additionally outfits couples to browse future financial obstacles with better simplicity. Inevitably, embracing monetary openness via an antenuptial agreement urges a much healthier, much more durable connection, where both companions feel secure in their common economic journey.

Securing Individual Properties and Inheritances

Antenuptial agreements act as essential devices for protecting private properties and inheritances. They define separate residential or commercial property and develop clear strategies for inheritance defense, making certain that personal riches remains distinctive during marital relationship. Additionally, these arrangements supply clarity regarding asset division, which can stop disagreements in case of a splitting up.

Specifying Separate Residential Or Commercial Property

Recognizing the concept of separate residential property is essential for individuals looking to protect their specific properties and inheritances within a marriage. Different residential or commercial property refers to possessions had by one partner before marriage or obtained by present or inheritance throughout the marital relationship. This classification is substantial as it helps delineate which assets stay individually owned and are not subject to division during separation process. To read the article assure properties are recognized as separate property, documentation and clear communication are necessary. Antenuptial contracts can explicitly specify these properties, safeguarding them from possible cases by the other partner. By establishing separate residential property, people can preserve control over their monetary future and maintain household heritages, guaranteeing that individual investments and inheritances remain intact.

Inheritance Security Methods

Protecting private assets and inheritances needs a calculated method, specifically for those who desire to keep their monetary freedom within a marital relationship. Antenuptial agreements work as a necessary device hereof, allowing people to define how assets gotten prior to and during the marital relationship will certainly be treated. By plainly detailing the ownership of inheritances, these contracts assure that such possessions remain separate, protecting them from possible insurance claims by a partner in the occasion of divorce or fatality. Additionally, couples can deal with future inheritances, marking them as separate home. This positive procedure not just secures private wealth but also cultivates openness and a fantastic read count on, permitting both partners to go into the marital relationship with a clear understanding of their monetary boundaries and obligations.

Asset Department Clearness

Quality in asset department becomes important for pairs seeking to protect their financial passions and individual possessions throughout a marriage. Antenuptial contracts function as a vital tool in this procedure, outlining the ownership of expectations and properties regarding their distribution in case of a separation or separation. By explicitly determining which possessions are considered individual and which are joint, pairs can minimize potential disputes and misconceptions. In addition, these agreements can guard inheritances, making sure that family members heritages continue to be undamaged and secured from department. By developing clear standards for possession department, pairs can cultivate a feeling of security and count on, eventually contributing to a much more unified marital partnership while getting ready for any unpredicted circumstances.

Clarifying Financial Responsibilities and Expectations

How can couples ensure a shared vision of their financial future? Antenuptial contracts function as a useful device for establishing clear monetary duties and assumptions. By plainly defining duties concerning income, expenditures, and savings, couples can minimize misunderstandings. Such agreements can outline exactly how joint and specific financial debts will certainly be managed and specify payments to shared expenses, creating a clear economic structure. On top of that, these contracts can resolve future economic goals, ensuring both parties are straightened in their ambitions. By setting these parameters beforehand, couples can promote open communication concerning financial resources, inevitably strengthening their collaboration. This proactive approach not just reduces potential conflicts however also advertises a collective monetary trip together.

Navigating Intricate Household Situations

When encountered with facility family members scenarios, pairs might find that antenuptial agreements supply important advice. These you can try these out contracts can attend to concerns such as mixed households, where kids from previous partnerships may have varying claims to possessions. By clearly defining possession and distribution of property, couples can minimize conflict and shield the passions of all events involved. Additionally, antenuptial agreements can address duties towards children from prior marital relationships, making sure that economic commitments are transparent and agreed upon. In scenarios involving substantial family members riches or company interests, these contracts can safeguard assets and clear up objectives. Inevitably, antenuptial agreements function as an aggressive procedure, promoting consistency and understanding in families handling intricate dynamics.

Planning for Future Modifications and Unpredictabilities

As life is naturally unpredictable, pairs often find it necessary to plan for future modifications and uncertainties with antenuptial agreements. These agreements work as aggressive procedures, allowing partners to outline their monetary duties and expectations ought to unforeseen conditions occur. Elements such as profession modifications, health issues, or family members characteristics can greatly affect a partnership. By attending to these possible circumstances ahead of time, pairs can cultivate open interaction and strengthen their dedication per other. Additionally, antenuptial contracts can aid alleviate disputes and secure individual passions throughout tough times. This level of preparedness not just supplies comfort but likewise enhances the structure of the relationship, ensuring that both companions really feel protected and valued despite what the future may hold.

How to Produce an Efficient Antenuptial Agreement

Developing an effective antenuptial agreement requires cautious factor to consider and clear interaction in between companions. At first, both people should honestly review their financial circumstances, consisting of properties, financial obligations, and future monetary objectives. Engaging a qualified attorney concentrating on family members law is essential to guarantee the contract conforms with lawful standards and addresses significant concerns. The agreement should detail residential property division, spousal support, and other financial plans, ensuring both parties' rate of interests are secured. Additionally, it is essential to review and upgrade the contract occasionally, specifically after substantial life adjustments such as the birth of children or changes in income. By fostering transparency and common respect, partners can create an extensive antenuptial contract that lays a strong foundation for their future together.

Frequently Asked Concerns

Can an Antenuptial Agreement Be Changed After Marital relationship?

An antenuptial agreement can potentially be customized after marriage, however this generally needs shared approval from both celebrations and may include legal processes to assure enforceability, depending on jurisdiction and details conditions bordering the agreement. (antenuptial contract)

What Takes place if We Don'T Have an Antenuptial Contract?

Without an antenuptial agreement, pairs skip to their territory's marital residential property laws. This can result in potential conflicts over possession department and economic obligations during marital relationship and in the occasion of splitting up or divorce.

Are Antenuptial Agreements Lawfully Binding in All States?

Antenuptial agreements are lawfully binding in most states, given they satisfy certain demands such as volunteer arrangement and full disclosure of properties. Nonetheless, enforceability might vary based upon state legislations and specific situations.

How Much Does It Typically Cost to Develop One?

Creating an antenuptial agreement typically sets you back between $1,000 and $3,000, depending on elements such as intricacy, attorney fees, and place - antenuptial contract. Pairs ought to get in touch with attorneys to acquire exact estimates based upon their certain needs

Can We Include Non-Financial Agreements in the Agreement?

Yes, non-financial agreements can be consisted of in an antenuptial contract. Couples usually outline assumptions relating to house responsibilities, child-rearing viewpoints, and various other personal dedications, making certain clarity and good understanding in their relationship.

The main objective of an antenuptial agreement is to develop clear assumptions and shield each event's monetary interests. antenuptial contract. Financial openness is vital in any type of connection, specifically when preparing an antenuptial contract. Antenuptial agreements offer as a structure for this openness, clearly detailing each companion's economic duties and assumptions. Antenuptial contracts serve as a useful tool for establishing clear financial responsibilities and expectations. Such agreements can describe how joint and private financial obligations will be managed and specify contributions to shared costs, creating a transparent monetary structure